Related searches

Small Business Funding Options: What’s Available?

When it comes to funding, small business owners have several avenues to explore. Traditional loans, grants, venture capital, and even crowdfunding can provide the necessary capital. Each option has its advantages and drawbacks, depending on your business goals, timeline, and financial health.

Small Business Funding Sources: Navigating Your Choices

Knowing where to look for funding is just as important as deciding which option to pursue. Banks, credit unions, government programs, and private lenders all offer funding opportunities. It’s vital to research the terms and conditions for each source to determine the best fit for your business’s financial strategy.

Small Business Funding Grants: Free Money for Your Business

Grants are highly sought after because they don’t need to be repaid. Government agencies and private organizations offer grants to small businesses, particularly those in specific industries or locations. However, securing a grant is often competitive, requiring a detailed application process and a clear business plan to stand out from other applicants.

Small Business Funding Loans: The Traditional Path

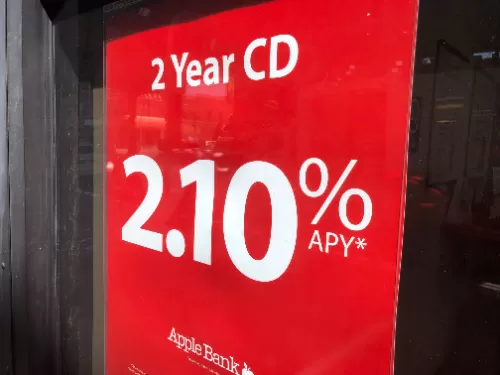

Small business loans remain one of the most common ways to secure funding. These loans can be obtained from banks, credit unions, and online lenders. Interest rates, repayment terms, and loan amounts vary, so it’s essential to shop around for the best deal. SBA (Small Business Administration) loans are also a popular option due to their government backing, making them less risky for lenders.

Small Business Funding for Startups: Getting Off the Ground

For startups, accessing funding can be challenging, especially with limited business history. Fortunately, many investors and lending programs are designed to support startups. Angel investors, venture capitalists, and crowdfunding platforms like Kickstarter or GoFundMe are excellent ways to raise funds without traditional loans.

Fast Small Business Funding: Quick Solutions for Urgent Needs

Sometimes, small businesses need capital fast, whether to cover unexpected expenses or take advantage of growth opportunities. Fast small business funding options, such as short-term loans, lines of credit, and merchant cash advances, can provide the liquidity needed in a short period. However, these often come with higher interest rates, so careful consideration is needed before committing.

Conclusion: Finding the Right Funding for Your Business

The right funding option can fuel your small business’s growth, helping you achieve your goals. From grants and traditional loans to startup funding and fast financing solutions, there’s a wide variety of choices. The key is to match your business needs with the most suitable funding source and make informed decisions th